Long term marketable securities are investments; a long term asset. Cash related to long term assets is reported in the investing section. This information allows businesses to forecast future cash needs, make informed investment decisions, and track actual performance against budgeted targets. As a result, the business has a total of $126,475 in net cash flow at the end of the year.

Business Insights

Prepare a statement of cash flows for the current year in proper format using theindirect method. The cash flow statement is an essential financial statement for any business as it provides critical information regarding cash inflows and outflows of the company. The cash flow statement shows if the company can sustain its operations, grow, and weather financial hiccups. Unlike other financial reports that might focus on profit, the cash flow statement deals purely with actual cash.

What is your current financial priority?

It shows the amount and timing of money in and outflows, i.E., Cash received and paid to suppliers, employees, investors, etc. The Cash Flow statement reports how much cash was generated or used by the firm, not how much profit was made. Another important function of the cash flow statement is that it helps a business maintain an optimum cash balance. Greg purchased $5,000 of equipment during this accounting period, so he spent $5,000 of cash on investing activities. Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. Increase in Accounts Receivable is recorded as a $20,000 growth in accounts receivable on the income statement.

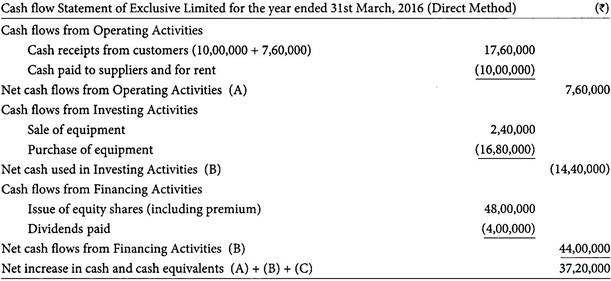

Calculated Using the Direct Cash Flow Method

This is done to see whether the revenues, expenses, and net income reported on the income statement are consistent with the change in the company’s cash balance. Investors use cash flow statements to understand a company’s approach to growth and capital investments. Cash flows from investing activities reveal whether a company is investing in new equipment, technology, or facilities.

- Since it’s simpler than the direct method, many small businesses prefer this approach.

- Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined.

- Remember the gains we subtracted from the sale of assets under cash flow from operating activities?

- This method measures only the cash received, typically from customers, and the cash payments made, such as to suppliers.

- Transactions in CFF typically involve debt, equity, dividends, and stock repurchases.

With the most likely used indirect method, the starting point of this section is the company’s net income. It is followed with adjustments to convert the amount of net income from the accrual method to automate 1099 form the cash amount. LO 16.3Use the following excerpts from IndigoCompany’s balance sheets to determine net cash flows from operatingactivities (indirect method), assuming net income for 2018 of$225,000.

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. 6) Retained earnings increased by $15,000 and the company earned income of $17,000 for the year. Assume that the change was all in cash ONLY when you have NO other information.

The ending balances of the balance sheet accounts is not useful information. Cash transactions impacting stockholders are reported as a financing activity. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The changes in the value of cash balance due to fluctuations in foreign currency exchange rates amount to $143 million. Thus, when a company issues a bond to the public, the company receives cash financing.

This makes it an essential tool for understanding if there’s enough cash to pay expenses and fund new projects or if the company needs to bring in more cash from loans or investments. 8) interest expense is part of net income in the operating section of the indirect statement. Revenues and expenses are not separately reported on the cash flow statement (unless they are not paid or received in cash).

A negative effect could also be thought of as a use of cash, a decrease in cash, or a negative amount on the cash flow statement. Positive cash flow reveals that more cash is coming into the company than going out. This is a good sign as it tells that the company is able to pay off its debts and obligations. Negative cash flow typically shows that more cash is leaving the company than coming in, which can be a reason for concern as the company may not be able to meet its financial obligations in the future. However, this could also mean that a company is investing or expanding which requires it to spend some of its funds. Therefore, it should always be used in unison with the income statement and balance sheet to get a complete financial overview of the company.